Why you shouldn’t rush investing and trading: check your personal finance foundation and privilege first.

In 2015, I heard about investing but didn’t know where to start. I moved from my first agency, Havas, in Jupiter Street, to DM9 Jayme Syfu Perea, Makati. I was an IT graduate who jumped to a digital marketing agency and is now excited to explore the industry of creativity. A few months earlier, I received a sizeable salary increase and promotion from Havas. But an opportunity came about for a fresh and optimistic start. I remember getting a comfortable salary for a young, single professional without dependents. Based on Maslow’s hierarchy of needs, I have the safety and privilege to pursue self-actualization — the desire to be the most possible.

At the time of this writing, I’m one of the millions forced to work from home because of the enhanced quarantine. Even months after our family evacuated from the immediate Taal volcano danger zone, I am still one of the few privileged quarantined employees with the convenience of receiving mobile banking access and notice that our salary was debited last Friday.

While almost everything is uncertain and on hold, let me share some reflections on the frameworks I’ve used and what I've learned. I hope this helps you reflect on your finances and set the right foundations as we bounce back together.

Our boss then, Carlo Ople, invited his friend Randell Tiongson to give a talk about personal finance. This was around November 2015, a few weeks before our 13th-month bonus was released. I knew Randell Tiongson attends Victory Church, and I was interested in how he’ll take personal finance in the workplace and what products he would recommend.

The one-hour talk became one of the most enlightening, genuinely caring, and not-selling-a-product talk about personal finance. I ended up buying his two books as thank you.

The same talk gave me the privilege and foundation years after. The discipline to prepare enough emergency cash during home quarantines, of having convenient options in case I lose a job, complementary cashflows to pay for international trips despite a stagnant 5-year salary drought, and the gut to risk 1-year without pay to take a Master’s program in AIM a few years back.

That’s why on this random quarantined Saturday morning in 2020 and a quarter full of crisis, I finally made time to start writing some of the personal-finance reflections and foundations I’ve learned, how it has given me the privilege of stability in this pandemic crisis, and why you shouldn’t rush investing or trading until you get these foundations checked:

What’s the summary of Randell’s talk? A no-nonsense 5-step guide for proper investing. I won’t discuss each step in detail but will share my reflections. Meanwhile, you can watch the video here or proceed to the sections below:

1. Increase your cash flow. AKA be indispensable and pirate-able.

Increasing your cash flow can mean upskilling or negotiating for a salary increase. It can start by reevaluating your career based on where you are, where your salary is with the market rate, and finding ways to add multiple income streams.

While you and your peers can answer best how you can improve your cash flow, here are some frameworks to start evaluating your career and cash flow.

I almost forgot. This also means investing in improving your mastery through training and programs. Throughout my career, I’ve had the privilege of getting my company to pay for training. Havas paid for my IMMAP Certified Digital Marketer Program, and Production Specialist track PHP 100,000+. And Dentsu covered my graduate school tuition fee worth PHP 600,000+. I’ll schedule writing some tips about those separately. Comment if you find that interesting so I can bump it up on my list!

Overall, how’s your cash flow? Which is the top 3 expense driver for you monthly? What are the trainings that can give you a medium-term salary multiplier that your company can pay with a win-win scenario? How indispensable are you in your team?

2. Getting out of debt. Bayad utang muna.

I can’t remember a significant debt since I didn’t have a credit card. The closest I remember is my debts to my dad for funding the leisure of buying an Android phone in college for “mobile app development research” and enrolling me in a junior digital Marketer program in Ateneo right after graduation.

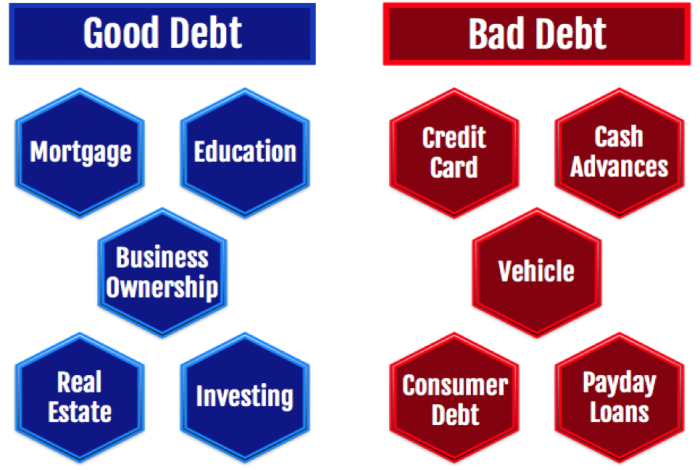

I remember having to go to every stall in Greenhills to look for the best priced Android phone back when the iPhone just started, and Blackberry phones were the “in” thing. I also recently learned through graduate school that there’s good debt that you can use as leverage, and there’s the bad debt that you keep on ignoring. Pay those debts even before signing up for an investment broker account.

Even if I didn’t have a sizeable debt or a sibling to support for college, I remember just having “enough” from paycheck to paycheck. My first four years were invested in “travel experiences.” In our first Barkada group vacation leave, I remember having to withdraw most of my salary since we had to pay and contribute to activities and credit card “abono.”

While I don’t regret them, I wish someone coached me to be more mindful.

The friend who keeps bugging you about the money you borrowed or contribution you intentionally disregard? The family contribution for aircon, ref, or PlayStation? Yup, pay up first.

3. Setting up an emergency fund. YOLO, Taal Evacuation, Medical bills, and COVID-19 slap us with the realities of uncertainties.

This was the hardest for me. My monthly operating expense was between 9,000 and 15,000 per month. Setting up six months of “emergency funds” during “sudden loss of a job or cash flow” for uncertainties felt unnecessary. It also means I have to save 90,000 and keep it floating. Imagine. If I were to save up for 5,000 per month. Will I have to wait for 18 months to complete step 3? Shouldn’t I be investing that money already? In my early 20s, that would have meant a new camera, a trip to Hong Kong or Singapore, a new gaming laptop, or a commercial drone.

During that talk, I only had 5,000 floating money, including the random 500 corner bills, and mostly waiting from paycheque to paycheque. I can’t even pay the minimum amount to open a passbook account. Saving up an emergency fund is usually the most challenging part since it questions our lifestyle and spending choices.

Cut to DM9, which Dentsu acquired. We got our bonus and pro-rated 13th-month early. And I suddenly had the most significant digit count in my ATM balance. While I imagined buying a new bike or booking a flight for an Indo-China trip, I was sure it had to go to my emergency fund.

And since the ladder says it’s step 3, I sucked it up and said I need to go through the discipline and understand that I need to complete these in-between exciting travel plans. The same discipline and sacrifices matter more than ever since we live in a VUCA environment. As our graduate school economics professor enumerates, it means volatile, uncertain, complex, and ambiguous. In less than three months in 2020, my dad went through a knee replacement surgery, our whole municipality got forced evacuated for the first time in 40+ years, I got confined with surcharge bills for an allergic reaction to an anti-rabies vaccine, and now the confirmed cases of COVID19 in the Philippines just surpassed the 1,000 mark with no signs of slowing down, yet.

In a VUCA environment, preparing for emergencies matters more. How much should you set up? Start with three months’ target of your LIVING EXPENSE. Calculate your non-negotiable expenses like rent, phone bills, food, and monthly transportation expenses. Then target to make it six months. Delay gratifications and reprioritize.

The beauty of foundations? It challenges your priorities and questions your discipline. Jump to Step 4

Step 4. Getting protected from life’s risks. Even the best and safest drivers need car insurance.

When you have enough money to travel leisurely, and the Cebu Pacific seat sale alert is turned on, the next challenge is finding the motivation to slice a portion and put money as insurance. You know, the money you pay for now just in case you die sooner and we realize that we only really live once? Before COVID-19, we were almost too certain that a “lockdown” or a “contagious pandemic” could happen in our lifetimes. I’ve said the same about the Taal Volcano eruption.

I remember scouting through my friend’s list and started looking for insurance agents, AKA financial advisors for AXA, SunLife, PruLife, and Manulife, only to move on to Step 5 and finally invest.

I met them all four advisors over lunch meetings in Greenbelt. Some products, terms, pricing, and duration were confusing. I had to group them in an Excel file to give me the illusion of objectivity. I encountered the term VUL, life insurance, UITFs, etc.

I checked my Google Sheets tracker and it apparently looked like

What did I end up getting?

A Manulife VUL for 25,000 per year times ten years. It was the lowest and most straightforward plan in the offer. Most importantly, it was offered by a familiar friend who’s x years older than me and was planning for his wedding. More than finances, I treated him as a financial coach. While a hybrid VUL has cons and a lazy option towards investing, it was a practical option of having a “hybrid insurance + investment” now and accelerate my finance journey. At that time, getting started for me was better than getting it perfect immediately.

Remember, the agents you are getting are the same person your parents will contact you for an eventual death claim. Would you rather trust that moment to a random agent in a bank or a mutual friend you look up to?

I understand agents earn a commission. But the value exchange I was willing to pay for was trust, advice, and inspiration. Do note that there are tons of comprehensive insurance products. VUL, CIB, Term insurance, Car insurance, and BTITD. Those are some jargon to pop-quiz your agents.

I’m not selling insurance, so I won’t try to explain this in detail. I’ll save that for your college or school friend who messaged you recently or the one posting tips, but you’ve been thinking twice about messaging.

But here are some anecdotes from my friends that hit the nail in the head on we need an insurance:

1. I have friends who can’t get insurance because they are no longer qualified

2. Our family and all my life plans got shattered when I lost my <insert family member here> unexpectedly.

3. My wedding got postponed because we had to contribute to my parent’s <insert critical illness>

4. When a family member dies, do you know you need to pay estate taxes first to be able to claim that money from the bank?5. I was safe driving, and a truck scratched my front bumper — good thing my car loan required insurance.

6. I trust this senior officemate, and I knew she could offer me sound financial advice and products

My advice, talk to at least 3 insurance agents from different providers, including the corner desk inside a bank who’d follow you up via SMS after inquiry. Then evaluate and decide based on who you trust the most just to get over it. Start small and start soon.

Step 5. Investing in your future

Finally! We’re here in the investing section.

What was the most significant investment I made in my early 20s? Pursuing a scholarship route for the MIB / Master of Science in Innovation & Business program. Going back to school or full-time graduate studies (with a PHP 900,000 price tag) was never part of my plans.

How did the five-step framework help me?

Let’s recap. Step 1, I was convinced the Master’s program would help increase my cash flow in the medium to long term. Step 2: I didn’t have the risk appetite to take a bank loan of almost a million, so I stayed away from debt and pitched internal funding to my bosses instead. Step 3: My emergency fund was in place, so I was confident about the idea of unpaid leave to learn. Step 4: I already have a Manulife VUL insurance investment, and Dentsu will retain my healthcare coverage, so my risk appetite for uncertainties was moderately aggressive. Step 5: I treat the program as my investment for the future.

Going back to the present. My 3 years bond in Dentsu is about to end. I went back to Step one of looking for projects and paid talks that increased my cash flow. From step two, I’ve managed to get out of (bad) debt. From step three, I’ve added a critical illness coverage that are usually not covered by company healthcards. As Step five, I’ve finally made time to open up a few stock market investment accounts and my investment now looks like this in 2020:

Do you realize how long that took???? About 4 to 5 years from Randell’s talk.

It took me five years to finally open an investment brokerage account. Part of it is because I burned half of my emergency fund (Step 3) for a year without pay and full-time graduate school at AIM in 2017. I treated it as a relatively low-risk and good debt as a bond from Dentsu.

While an investment can mean stock market equities, step 5 for me started by taking the risk for a graduate school loan at AIM, the premier business school in Asia. Or the old CCP-like structure — across Greenbelt 1 with international flags — that turns out to be the number 1 business school of choice for the top companies in the Philippines.

Investing for your future is not just about mutual funds and the stock market. It can also be about significant conferences, training, or time in joining communities that will help you grow professionally and with mastery. Your most important investment should be in yourself first.

What are your self-investment goals?

What would help your reach 2x, 5x, 10x growth in your career?

The reward of taking the rigor of steps 1 to 4 before step 5? It gives you discipline and sanity during uncertain times like a pandemic. It reminds you that you shouldn’t invest your emergency fund.

My takeaways? Some foundations for Investors/Traders wanna-be:

1. Start with the basics. Stop rushing life.

2. Set your own pace.

3. Foundations help us grounded on uncertain and black swan times.

4. Where your money is. There, your heart is. Where is it now?

5. Going through personal finance framework is a privilege

During this pandemic, let’s reflect on our finances and privilege. Thinking about our finances instead of worrying about having something to eat or getting money is already a privilege. And as soon as we can, let’s create, support, and share solutions that can make the future exciting, not just within our echo chambers. But for everyone.

Whew. That was long. It could work as a script for a long-form vlog.

Was that helpful? Follow my YouTube account and skim through these articles to learn more. I would appreciate it.

How’s your finance journey? Are you just about to start? In quarantine? Or getting there? Let’s discuss below: